Columbia Threadneedle's director of responsible investment Simon Bond has announced he will retire in 2023 after almost four decades in the investment industry and 19 years at the firm.

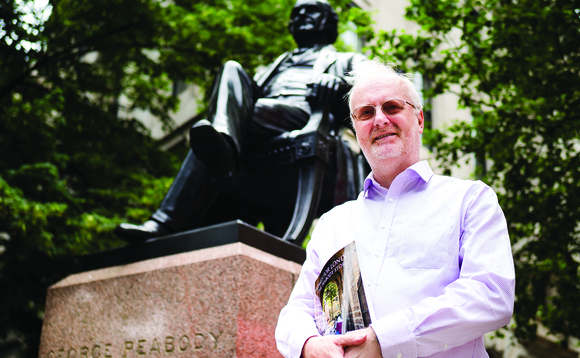

A long-standing manager of the Threadneedle UK Social Bond fund, he will end his fund management responsibilities on 30 June 2022. After that date, Bond (pictured) will move to a part-time role supporting the firm's EMEA-based social bond funds and remain a member of the social advisory committees.

Tammie Tang, who currently works as the fund's deputy manager, will take over as lead manager of the firm's UK and European social bond funds. She has managed high grade credit portfolios at Columbia for ten years and been deputy on the fund for the last four.

Sustainable & ESG Investment Awards winner interview: Simon Bond, Columbia Threadneedle Investments

Having specialised in corporate bonds for 30 years, Bond helped drive the development of a green, sustainability and social credit market and was instrumental in the issuance of the UK's first green sovereign bond, according to Columbia Threadneedle.

A spokesperson said: "Simon is a pioneer of social bond investing and we thank him for his contribution to our business and clients."

Bond won Investment Week's award for Outstanding Contribution to Sustainable & ESG Investing at our Sustainable Investment Awards last November.

Launched in 2013, the Threadneedle UK Social Bond fund was the first daily liquid fund to target bonds that benefit society, bringing social investment into the mainstream.

Following the announcement, Morningstar has placed the fund under review and will meet with the managers in due course to review these changes.

"Threadneedle UK Social Bond fund, which Simon has managed since its inception, was one of the first funds to feature on ii's ACE 40 rated list, due to Simon's impressive experience as a manager, and the fund's respectable performance," said Dzmitry Lipski, head of fund research at interactive investor.

"However, as Simon takes a step back from the day-to-day running of the fund after so many years, Morningstar must take the time to properly assess whether this changes anything going forward, and whether we can continue to recommend it."